Are you and your spouse struggling to manage your finances together? Don't worry, you're not alone. Money can be a major source of stress in many marriages. But taking control of your finances together can lead to a happier and more harmonious relationship. In this article, we will explore different strategies for managing money as a couple and provide helpful tips to improve your financial well-being. So, let's dive in and discover how to navigate the world of finances in your marriage.

Understanding Financial Harmony

When it comes to managing money in your marriage, finding financial harmony is crucial. It's not just about budgeting and saving, but also about creating a strong foundation of trust and open communication with your partner. Financial issues can often cause tension and stress in a relationship, but with the right approach, you can navigate these challenges together.

Financial harmony is about aligning your goals and values when it comes to money. It's about understanding each other's perspectives and finding common ground. This means taking the time to listen to each other, to be patient, and to compromise when necessary.

Financial harmony also means being accountable to each other. It's about being transparent with your spending habits, debts, and financial goals. This level of honesty and openness can strengthen your relationship and build a solid financial foundation for your future.

The Power of Financial Unity

Financial unity is essential in a marriage. It's about working together to achieve your shared financial goals. This unity allows you to support each other and make financial decisions as a team.

According to financial expert Suze Orman, "Couples who work together, improve together."1 When you're both actively involved in managing your finances, you can have a better understanding of your financial situation and make informed decisions.

Financial unity also helps build trust and prevent financial disagreements. By regularly discussing your financial goals and progress, you can avoid misunderstandings and foster a sense of collective responsibility.

The Importance of Shared Financial Goals

Setting shared financial goals is an important step towards financial harmony. It allows you and your partner to work towards a common vision of your future. Whether it's saving for a house, paying off debt, or planning for retirement, having shared goals can motivate you both to stay on track.

According to financial advisor Dave Ramsey, "A budget is telling your money where to go instead of wondering where it went."2 Creating a budget together can help you align your spending with your shared goals and ensure you're both on the same page.

Communicating with Empathy

Effective communication is key to achieving financial harmony. It's important to communicate with empathy, understanding, and respect. Take the time to listen to your partner's concerns, fears, and aspirations when it comes to money.

Financial expert Rachel Cruze suggests using "I feel" statements when discussing money issues. For example, instead of saying, "You always spend too much," you can reframe it as, "I feel worried when I see our credit card balance increasing."3 This approach allows you to express your perspective while avoiding blame or judgment.

Seeking Professional Help

Sometimes, despite your best efforts, financial issues can become overwhelming. If you find yourselves constantly arguing about money or unable to find common ground, it may be helpful to seek professional help. Financial advisors or marriage counselors can provide guidance and support in navigating these challenges.

Remember, managing money in a marriage is a journey, and financial harmony is something you continuously work towards. By understanding each other's perspectives, setting shared goals, and communicating effectively, you can build a solid financial foundation and strengthen your relationship for years to come.

Setting Financial Goals as a Couple

Setting financial goals as a couple is an essential part of building a strong foundation for your future together. It's an opportunity to align your aspirations and work towards a shared vision of financial success. By setting goals together, you can create a roadmap that will help guide your decisions and ensure that you are both working towards the same objectives. Here are some tips to help you set and achieve your financial goals as a couple:

Start with an open and honest conversation: To set effective financial goals, you must first have a candid discussion with your partner about your individual financial values, dreams, and desires. This conversation allows you to understand each other's perspectives and priorities, ensuring that your goals are aligned.

Identify your short-term and long-term goals: Begin by identifying your short-term goals, such as paying off debt, saving for a vacation, or buying a new car. Then, move on to discuss your long-term goals, such as buying a house, saving for retirement, or starting a family. Be specific when setting your goals, including the amount of money you want to save or the timeline for achieving them.

Make your goals SMART: SMART goals are specific, measurable, attainable, relevant, and time-bound. By following this framework, you create clear and actionable goals that are more likely to be achieved. For example, instead of setting a vague goal like "save more money," a SMART goal would be "save $10,000 for a down payment on a house in the next two years."

Break down your goals into smaller milestones: Sometimes, tackling big financial goals can feel overwhelming. To make them more manageable, break them down into smaller milestones. Celebrating these smaller victories along the way will keep you motivated and help you stay on track. As Dave Ramsey wisely said, "Goals are dreams with deadlines".

Establish a timeline and prioritize: Assign a timeline to each goal and determine which ones are most important to you as a couple. By doing so, you can focus your efforts and resources on the goals that matter most. Remember, financial goals are not meant to be rigid; they can be adjusted as circumstances change. The key is to communicate openly and regularly about your progress and make adjustments when needed.

Develop a plan to achieve your goals: Once you have set your financial goals, it's time to develop a plan to achieve them. This plan should include actionable steps, such as creating a budget, reducing expenses, increasing income, and maximizing savings. Working together as a team, you can strategize and support each other in implementing the plan.

Stay committed and accountable: Achieving financial goals requires consistent effort and commitment. Stay motivated by regularly reminding yourselves of the rewards and benefits that will come from achieving these goals. Hold each other accountable for sticking to the plan and making the necessary sacrifices along the way. Remember, it's a journey you're taking together, and the destination will be worth it.

Setting financial goals as a couple is an opportunity to strengthen your relationship, grow as individuals, and build a secure financial future. By working together, communicating openly, and supporting each other along the way, you can turn your dreams into reality. As Suze Orman once said, "When couples are in harmony with money, there is nothing they can't accomplish together".

Creating a Joint or Separate Bank Accounts

One of the most important decisions you and your partner will make when it comes to managing money in your marriage is whether to have joint or separate bank accounts. While there is no one-size-fits-all answer, this decision can have a significant impact on your financial harmony.

The Case for Joint Bank Accounts

"Having joint accounts helps foster financial transparency and create a sense of togetherness," says financial advisor Carol Anderson. When you pool your money together, it becomes easier to track your spending, budget effectively, and work towards common financial goals. Joint accounts can also promote open communication about money, allowing you to make financial decisions together and avoid surprises or hidden financial issues.

The Case for Separate Bank Accounts

On the other hand, some couples prefer to maintain separate bank accounts. This can provide a sense of independence and autonomy in managing individual finances. "Separate bank accounts can bring a sense of security and personal freedom," explains marriage counselor Sarah Williams. It allows each person to have their own spending money without feeling the need to justify every purchase. This can help prevent conflicts around money and give each partner a sense of control over their own financial destiny.

Finding a Middle Ground

If you're unsure whether to have joint or separate accounts, consider a compromise that allows you to have the best of both worlds. One option is to maintain a joint account for shared expenses such as mortgage, utilities, and groceries, while also having separate accounts for personal spending. This way, you can maintain financial transparency while still having some degree of financial independence.

Ultimately, the decision between joint or separate bank accounts is personal and depends on your unique circumstances as a couple. However, it's important to remember that regardless of the type of account you choose, "open communication and trust are key to successfully managing your finances as a couple," says financial planner Mark Johnson. By being transparent and supportive of each other's financial goals, you can work together to build a solid financial foundation for your marriage.

Budgeting for Two

One of the most important aspects of managing money as a couple is budgeting. Having a budget allows you to track your expenses, save for the future, and work towards your financial goals together. When you combine your lives, you also combine your financial situations. It's crucial to take the time to create a budget that reflects both of your needs and priorities.

Why Budgeting is Essential

Budgeting provides a clear roadmap for your finances, ensuring that you and your spouse are on the same page when it comes to spending and saving. Without a budget, it's easy to overspend and live beyond your means, which can lead to stress, arguments, and financial difficulties.

According to financial expert John C. Maxwell, "A budget is telling your money where to go instead of wondering where it went." By assigning every dollar to a specific category, you can ensure that you're making intentional choices with your money and avoid unnecessary debt.

Creating Your Budget Together

To create a budget that works for both of you, start by discussing your financial goals and priorities as a couple. What are your shared dreams? Do you want to save for a down payment on a house, pay off student loans, or plan for a dream vacation together? Understanding each other's financial aspirations will help shape your budget.

Once you've identified your goals, gather all of your financial information, such as income, expenses, debts, and savings. Use this information to create a comprehensive list of your monthly income and expenses. Be sure to include both fixed expenses, such as rent or mortgage payments, and variable expenses, such as groceries and entertainment.

Next, allocate your income to cover your expenses, savings, and any debt payments you may have. Prioritize your goals and be realistic about what you can afford. Remember, it's essential to live within your means and avoid unnecessary debt.

Implementing and Adjusting Your Budget

Now that you have created your budget, it's time to put it into action. Use a budget template or a budgeting app to track your expenses and monitor your progress. Be accountable to each other and hold regular check-ins to discuss your financial situation. This will help you stay on track and make any necessary adjustments along the way.

Always be open to revisiting and adjusting your budget as needed. Life circumstances change, and your financial goals may evolve over time. Make sure to communicate and make decisions together to keep your budget aligned with your shared vision for the future.

The Benefits of Budgeting as a Couple

Budgeting as a couple has numerous benefits. Firstly, it fosters financial transparency and creates an environment of trust in your marriage. By openly discussing your financial situation and working together to achieve your goals, you are strengthening your bond and building a solid foundation for your future.

Secondly, budgeting helps you stay organized and in control of your finances. As a couple, you can support each other in making responsible financial decisions and hold each other accountable for sticking to the budget.

Lastly, budgeting allows you to enjoy peace of mind and reduce financial stress. According to financial advisor Suze Orman, "When you control your money, you control your destiny." By budgeting, you are taking control of your financial future and ensuring a more stable and secure life together.

So take the time to create a budget that reflects both of your needs and aspirations. By doing so, you will be well on your way to achieving financial harmony and building a strong financial foundation for your marriage.

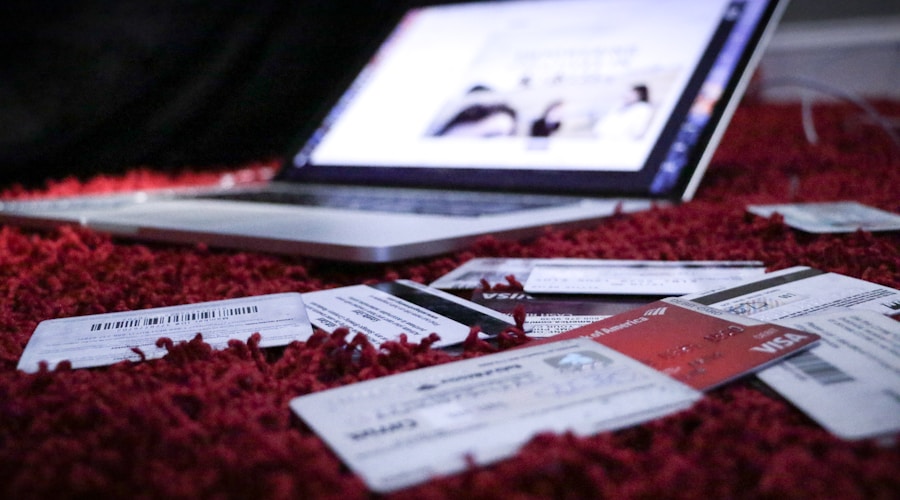

Discussing Debt and Credit

Debt and credit can be sensitive topics to discuss in any situation, but it becomes especially important to address them as a couple. Ignoring or avoiding these conversations can lead to financial stress, disagreements, and even damage to your relationship. It's crucial to have open and honest discussions about your debt and credit situation to ensure a healthy financial future together.

The Importance of Transparency

One of the first steps in discussing debt and credit with your spouse is being transparent about your individual financial situations. This means sharing information about any outstanding debts, loans, or credit card balances you may have. Lack of transparency can lead to misunderstandings and confusion, which can easily escalate into bigger issues down the line.

Start the Conversation with Empathy

When discussing debt and credit, it's important to approach the conversation with empathy and understanding. Remember that it's not about placing blame or pointing fingers, but rather finding solutions and support. Acknowledge that everyone's financial journey is different, and try to create a safe space where both partners can openly share their concerns and fears.

Take Ownership and Accountability

Regardless of who brought debt into the relationship, it's crucial to take ownership and accountability as a couple. Avoid assigning blame to one another and instead focus on finding ways to overcome the challenges together. As financial expert Suze Orman once said, "Debt is a way of life for many people, but it doesn't have to be your way of life. Take control and make a change."

Seeking Professional Help

If you find it difficult to navigate the complexities of debt and credit on your own, seeking professional help can be beneficial. Financial advisors or credit counselors can provide guidance and help you develop a plan to manage your debt effectively. Remember, asking for help is a sign of strength and shows your commitment to a healthier financial future.

Setting Debt Repayment Goals

Once you have a clear understanding of your debt situation, it's essential to set debt repayment goals together. Set realistic and achievable targets that align with your overall financial goals as a couple. This could mean prioritizing high-interest debts or creating a debt snowball plan. The important thing is to have a plan in place and work towards it together.

Celebrate Milestones and Progress

Paying off debt can be a long and challenging journey. It's important to celebrate milestones and progress along the way. Whether it's paying off a credit card or reducing a loan balance, acknowledging your achievements can boost morale and motivate you to keep going. As financial guru Dave Ramsey said, "Debt is dumb, cash is king, and the paid-off home mortgage has taken the place of the BMW as the status symbol of choice."

Continual Communication

Lastly, it's crucial to keep the lines of communication open when it comes to debt and credit. Make it a habit to discuss your financial progress regularly and re-evaluate your strategies if necessary. By maintaining ongoing conversations, you can stay on top of your financial goals, make adjustments when needed, and ensure that you're always moving in the right direction.

Remember, discussing debt and credit in your marriage is not about dwelling on the past or dwelling on mistakes. It's about working together to build a strong financial foundation for your future. By approaching these conversations with empathy, transparency, and a shared sense of responsibility, you can overcome challenges and create a brighter financial future for yourselves.

Handling Income Disparity

One of the challenging aspects of managing money in a marriage is dealing with income disparity. It can cause tension and a sense of inequality between partners. However, instead of letting it become a source of conflict, it can be an opportunity to strengthen your relationship and work towards financial harmony.

Understanding the Impact

Income disparity can arise due to various reasons such as different career choices, educational backgrounds, or personal circumstances. It may feel unfair if one partner earns significantly more than the other. It is essential to acknowledge the impact this has on both partners and approach the situation with empathy and understanding.

Open and Honest Communication

The key to overcoming income disparity is open and honest communication. Talk about your feelings and concerns, and listen to your partner's perspective as well. Remember, it's not about playing the blame game but finding solutions that work for both of you. Be willing to have difficult conversations and work together towards financial equality and fulfillment.

Embracing Financial Teamwork

Instead of focusing on individual incomes, consider adopting a team mindset when it comes to money. Embrace the idea of working together as a couple towards shared financial goals and aspirations. By pooling your resources, you can build a stronger financial foundation and achieve greater financial security.

Equal Contribution, Different Roles

It's important to remember that income doesn't determine the value each partner brings to the relationship. Recognize and appreciate the non-financial contributions that each partner makes, such as managing the household, raising children, or supporting each other emotionally. Your worth as a partner is not solely defined by your income.

Strategies for Balance

To address income disparity, consider implementing strategies that balance the financial scales. This could involve adjusting responsibilities and contributions based on each partner's abilities and circumstances. For example, the partner with higher income may choose to contribute more towards expenses, while the other partner can contribute in other ways such as taking care of household tasks or managing investments.

Seeking Professional Advice

In some cases, seeking the guidance of a financial advisor or marriage counselor can be helpful. They can provide unbiased advice and insights tailored to your specific situation. They can assist in creating a financial plan that takes into account income disparity and ensures that both partners feel empowered and valued.

Handling income disparity in a marriage is not an easy task, but with open communication, teamwork, and understanding, it can be overcome. Remember, you are partners in every aspect of your life, including finances. By working together, you can navigate income disparity and build a strong and harmonious financial future for yourselves.

Savings and Investments Strategy

When it comes to building a financially secure future, a strong savings and investments strategy is crucial. This strategy will not only help you achieve your long-term goals, but also provide you with a safety net for unexpected expenses. Here are some key steps to consider when developing your savings and investments strategy as a couple.

Set Shared Financial Goals: Before you begin saving and investing, it's important to have a clear understanding of what you both want to achieve. Discuss your dreams and aspirations, whether it's buying a house, starting a family, or traveling the world. By aligning your goals, you can work together towards a common financial vision.

Create an Emergency Fund: Life is full of surprises, and having a cushion to fall back on can provide peace of mind. Experts recommend saving three to six months' worth of expenses as an emergency fund. This will help you weather unexpected expenses such as medical bills, car repairs, or job loss.

Diversify Your Investments: As the saying goes, "Don't put all your eggs in one basket." Diversifying your investments can help protect your money from market fluctuations and reduce risk. Consider investing in a mix of stocks, bonds, real estate, and other asset classes that align with your risk tolerance and long-term goals.

Start Retirement Planning Early: Retirement may seem far away, but it's never too early to start planning for it. The power of compound interest means that the earlier you begin saving for retirement, the more time your money has to grow. Make use of retirement accounts such as 401(k)s or IRAs and take advantage of any employer matching contributions.

Seek Professional Advice: Managing your savings and investments can be challenging, especially if you don't have a background in finance. Consider consulting with a financial advisor who can provide you with personalized guidance based on your unique circumstances. They can help you assess your risk tolerance, develop an investment plan, and monitor your progress over time.

Remember, saving and investing is a journey, not a sprint. It requires discipline, patience, and commitment. By working together as a couple, you can maximize your potential for long-term financial success.

As Ralph Waldo Emerson once said, "The only person you are destined to become is the person you decide to be." By taking control of your savings and investments strategy, you are making a conscious decision to build a stronger financial future for yourself and your partner.

Invest in your future today and reap the rewards tomorrow.

Planning Major Purchases Together

Making major purchases as a couple can be both exciting and challenging. Whether it's buying a new car, a house, or even planning a dream vacation, these decisions require careful consideration and planning. In order to ensure financial harmony, it's important for you and your spouse to align your goals, communicate effectively, and make well-informed decisions together.

1. Discuss and Prioritize

Before making any major purchase, take the time to discuss and prioritize your goals as a couple. This will help you understand each other's desires and expectations. It's essential to listen attentively and respect each other's opinions, even if they differ from your own.

As financial expert Suze Orman once said, "When it comes to money, you have to respect each other's differences and celebrate your similarities." By having open and honest conversations, you can ensure that you are on the same page and avoid conflict down the road.

2. Set a Budget

Once you have established your priorities, it's crucial to set a budget for your major purchase. By doing so, you can determine how much you can afford to spend and what options are realistic for your financial situation.

Creating a budget together not only helps you stay on track financially but also fosters a sense of teamwork and shared responsibility. It allows you to make choices that align with your long-term goals as a couple.

"A budget is telling your money where to go instead of wondering where it went."

3. Research and Compare

Before making a major purchase, it's essential to conduct thorough research. Look for the best deals, compare prices, read reviews, and consider all the options available to you. This will help you make an informed decision and get the most value for your money.

Take advantage of online resources, visit different stores, and don't hesitate to ask for recommendations from friends or family members who have made similar purchases. By doing your homework together, you can ensure that you are making a well-informed decision that aligns with your financial goals.

4. Consider Long-Term Financial Impact

When planning a major purchase, it's important to consider the long-term financial impact it may have on your marriage. Will this purchase put a strain on your budget or hinder your ability to save for other goals?

By discussing the potential consequences and weighing the pros and cons together, you can make a decision that aligns with your overall financial plan. Remember, it's not just about the present moment but also about the future stability and prosperity of your marriage.

5. Involve a Financial Advisor

If you and your spouse are unsure about how to navigate a major purchase, consider seeking guidance from a financial advisor. A professional can provide you with expert advice and help you make the best decision for your unique circumstances.

A financial advisor can analyze your financial situation, evaluate various options, and guide you towards the most optimal choice. Their expertise can alleviate any uncertainty or anxiety you may have, allowing you to make a confident decision as a couple.

Making major purchases as a couple can be an exciting journey filled with anticipation and joy. By planning and discussing your goals, setting a budget, researching options, considering the long-term impact, and seeking guidance when needed, you can make informed decisions that promote financial harmony in your marriage.

Remember, it's not just about the purchase itself, but also about the journey you take together as a couple. By aligning your financial goals and working as a team, you can create a solid foundation for a prosperous future.

Retirement Planning as a Couple

Planning for retirement is an important aspect of your financial journey as a couple. It is a time when you can start envisioning your future together and set goals for your golden years. Retirement may seem far away, but it's never too early to start planning and saving for it. Here are some key points to consider when it comes to retirement planning as a couple:

Start Early, Stay Consistent

When it comes to retirement planning, starting early is crucial. The sooner you begin saving, the more time your money has to grow. Remember, compound interest can work wonders over the years. As financial expert Dave Ramsey once said, "Retirement planning is not a sprint, it's a marathon." Consistency is also important. Make regular contributions to your retirement accounts and avoid the temptation to dip into those funds for other purposes.

Set Common Goals

Retirement planning requires both partners to come together and discuss their desires for the future. It's important to have open and honest communication about your retirement goals. Ask yourselves questions like, "When do we want to retire?", "What kind of lifestyle do we envision for ourselves?", and "What are our financial expectations for retirement?" By setting common goals, you can align your efforts and work towards a shared vision.

Maximize Retirement Accounts

Take advantage of retirement accounts such as a 401(k) or Individual Retirement Account (IRA). These accounts offer tax advantages and can help you build a substantial nest egg for retirement. Consider maximizing your contributions to these accounts, especially if your employer offers a matching contribution. As financial advisor Suze Orman once said, "The money you save in your 20s and 30s is by far the most important saving you're ever going to do in your life."

Diversify Your Investments

Diversifying your investments is a key strategy to protect your retirement savings. Spread your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risks and potentially maximize returns. Seek guidance from a financial advisor who can help you design an investment portfolio that aligns with your risk tolerance and long-term goals.

Continuously Reevaluate

Retirement planning is not a one-time event. As your circumstances change, it's important to regularly review and adjust your retirement plan. Life events like a salary increase, job change, or the birth of a child can impact your retirement goals and require adjustments to your savings and investment strategy. Regularly reevaluating your plan will help ensure that you stay on track towards achieving your retirement goals.

Retirement planning as a couple requires commitment, communication, and shared goals. By starting early, setting common goals, maximizing retirement accounts, diversifying investments, and continuously reevaluating your plan, you can work towards a financially secure and fulfilling retirement. Remember, as financial expert Robert Kiyosaki once said, "It's not what you make, but what you keep, that determines your financial future." Start planning for your future together today.

Financial Communication in a Marriage

Open and honest communication is the key to a successful marriage, and that includes discussing finances. Money can be a sensitive topic, but it's crucial to address it head-on in order to avoid serious conflicts down the road. Here are some tips for effective financial communication in your marriage:

Schedule regular money talks: Set aside dedicated time to discuss your financial goals, concerns, and progress. Treat it as a priority and make it a regular part of your routine. This will help you stay on track and prevent any surprises or misunderstandings.

Be transparent: Share your financial information openly with your spouse. "Transparency is vital in managing money as a couple," says financial expert Suze Orman. "You should know everything about your partner's financial situation - debts, income, assets - and vice versa."

Listen actively: When discussing financial matters, it's important to truly listen to your partner's concerns and opinions. Pay attention to their ideas and be respectful of their perspective. "Understanding each other's money mindset is the foundation of financial harmony," advises relationship coach John Gottman.

Avoid blame or judgment: Money can be a source of tension in a relationship, but it's important to avoid blaming or shaming each other. Instead, focus on finding solutions together. Financial expert Dave Ramsey suggests that "instead of playing the blame game, focus on teamwork. You're in this together, and together you can overcome any financial challenge".

Set shared goals: Discuss your financial aspirations as a couple and work towards them together. Whether it's saving for a dream vacation, buying a house, or planning for retirement, having shared goals can bring you closer and keep you motivated.

Create a budget together: Budgeting is an essential tool for financial success. Sit down with your spouse and create a budget that reflects your joint priorities and financial realities. By working together on this, you'll be able to track your spending, make necessary adjustments, and ensure that you're both on the same financial page.

Remember, healthy financial communication is not just about discussing numbers; it's about understanding each other's dreams, fears, and priorities. By openly discussing money matters, you'll build trust, strengthen your bond, and set a solid foundation for your financial future together.

Revisiting and Adjusting Your Financial Plan

Once you and your partner have established your financial plan, it's important to regularly revisit and adjust it as needed. Life is constantly changing, and your financial goals and circumstances may shift over time. By regularly evaluating and adjusting your financial plan, you can ensure that you stay on track and make any necessary modifications to align with your current situation.

Regular Check-Ins

Regularly checking in on your financial plan allows you to assess its progress and make any necessary changes. This can help you stay accountable to your goals and ensure that you are both working towards them together. It also provides an opportunity to have open and honest conversations about any adjustments or challenges that may have arisen.

Reassessing Your Goals

As your circumstances change, it's essential to reassess your financial goals. Maybe you've achieved a major milestone and need to set new objectives. Or perhaps you're facing unexpected expenses and need to reallocate your resources. By revisiting your goals, you can ensure that they are still aligned with your aspirations and make any necessary adjustments to keep them attainable.

Adapting to Life Changes

Life is full of changes, both expected and unexpected. From career transitions to family expansion, these life events can have a significant impact on your financial plan. It's important to be flexible and adaptable to these changes, and adjust your plan accordingly. This may involve reevaluating your budget, revising your savings and investment strategies, or updating your retirement plan.

"In the journey of a marriage, it's essential to remember that your financial plan is not set in stone. Just as life brings unexpected challenges and joys, so too will your finances evolve. Regularly revisiting and adjusting your financial plan ensures that you stay aligned with your goals and can navigate any twists and turns that come your way."

Seeking Professional Guidance

If you find yourself struggling to make the necessary adjustments to your financial plan, it can be beneficial to seek professional guidance. Financial advisors or planners can provide valuable expertise and help you make informed decisions. They can also offer objective perspectives and solutions tailored to your specific circumstances and goals.

Communicating and Collaborating

As you revisit and adjust your financial plan, it's crucial to maintain open and effective communication with your partner. Be transparent about any changes, concerns, or challenges that arise. Listen to each other's perspectives and work together to find solutions that meet both of your needs and aspirations.

"Successful financial planning in a marriage requires ongoing communication and collaboration. By openly discussing your financial goals, challenges, and adjustments, you can ensure that you are both actively working towards a secure and prosperous future."

Remember, your financial plan is a dynamic and living document. By regularly revisiting and adjusting it, you can ensure that it continues to reflect your evolving circumstances and aspirations. Embrace change, navigate life's twists and turns together, and stay committed to your shared financial journey.

Dealing with Financial Difficulties

Financial difficulties are something that many couples will inevitably face at some point in their marriage. Whether it's due to unexpected expenses, job loss, or mounting debt, the stress that comes with financial hardships can take a toll on your relationship. However, it is important to remember that you are not alone in this struggle, and there are steps you can take to navigate these challenging times together.

Acknowledge the Situation - The first step in dealing with financial difficulties is acknowledging the situation. It's essential for both partners to come together and have an open and honest conversation about your financial struggles. By addressing the issue head-on, you can start working towards finding a solution.

Seek Professional Help - If you find yourselves overwhelmed with debt or struggling to make ends meet, don't hesitate to seek professional help. A certified financial planner or credit counselor can provide valuable guidance and advice on how to manage your financial difficulties. Remember, seeking help is not a sign of weakness, but rather a proactive step towards improving your financial situation.

Create a Financial Plan - In times of financial hardship, having a solid plan can provide a sense of direction and clarity. Sit down together and create a budget that outlines your income, expenses, and financial goals. This will help you prioritize your spending, cut back on unnecessary expenses, and allocate funds towards paying off debt or building an emergency fund.

Cut Expenses and Increase Income - When faced with financial difficulties, it may be necessary to make some temporary sacrifices and cut back on expenses. Look for areas where you can reduce costs, such as dining out less or canceling unused subscriptions. Additionally, explore opportunities to increase your income, such as taking on a part-time job or freelancing.

Support Each Other Emotionally - Dealing with financial difficulties can be emotionally draining and put a strain on your marriage. It is crucial to support each other emotionally during this time. Express your concerns, fears, and worries to one another and offer words of encouragement. Remember, you are a team, and together you can overcome any financial challenge.

Focus on the Positive - It's easy to get caught up in the negativity when facing financial difficulties. However, it is important to focus on the positive aspects of your relationship and life. Celebrate small wins along the way, such as paying off a certain amount of debt or reaching a savings milestone. By acknowledging your progress, you can stay motivated and optimistic during tough times.

In the words of financial author Suze Orman, "You have been through tough times before and made it through stronger and wiser. I have no doubt you will do so again now." Remember, difficult times provide an opportunity for growth and resilience. By facing your financial difficulties together as a couple, you can come out stronger and more united than ever before.

Conclusion

"The key to financial harmony in a marriage is open and honest communication about money. Couples must have regular conversations about their income, expenses, and financial aspirations. By understanding each other's financial priorities and making joint decisions, couples can work towards their shared goals and build a solid foundation for their financial future." - Financial Advisor

"When it comes to managing money in a marriage, it is important to remember that it's not about 'your' money or 'my' money, but rather 'our' money. By creating a joint bank account or finding a system that works for both partners, couples can avoid power dynamics and foster a sense of equality and shared responsibility." - Marriage Counselor

By maintaining financial transparency, couples can navigate challenges such as income disparity and debt with understanding and support. It is important to approach these discussions with empathy and a willingness to find solutions that work for both partners. Furthermore, couples should prioritize savings and investments, plan major purchases together, and create a retirement strategy that aligns with their shared goals.

Remember, managing money in a marriage is an ongoing process that requires regular communication and adjustments. By being proactive, discussing financial difficulties openly, and seeking professional help when needed, couples can overcome financial challenges and create a strong financial foundation for their marriage. As the saying goes, "In marriage, the key to financial success is working together as a team."

2Dave Ramsey, The Total Money Makeover (2003)

3Rachel Cruze, Love Your Life, Not Theirs: 7 Money Habits for Living the Life You Want (2016)

4Dave Ramsey, Financial Peace (1992)

5Suze Orman, The Money Book for the Young, Fabulous & Broke (2005)

6Carol Anderson, Money Matters: Managing Finances in Your Marriage (2018)

7Sarah Williams, The Secrets of Financial Harmony (2017)

8Mark Johnson, Building a Strong Financial Future Together (2019)

9John C. Maxwell, "The Total Money Makeover" (2003)

10Suze Orman, "The Money Book for the Young, Fabulous & Broke" (2005)

11Suze Orman, The Money Book for the Young, Fabulous & Broke (2007)

12Dave Ramsey, The Total Money Makeover: A Proven Plan for Financial Fitness (2003)

13Dave Ramsey, Financial Peace (1992)

14Dave Ramsey, Financial Peace (1992)

15Suze Orman, "The Money Class: How to Stand in Your Truth and Create the Future You Deserve" (2011)

16Unknown Author

17Dave Ramsey, "Financial Peace" (1992).

18Suze Orman, "The Courage to Be Rich" (1999).

19Robert Kiyosaki, "Rich Dad Poor Dad" (1997).

20Suze Orman, "The Money Class: Learn to Create Your New American Dream" (2011)

21John Gottman, "The Seven Principles for Making Marriage Work" (1999)

22Dave Ramsey, "The Total Money Makeover: A Proven Plan for Financial Fitness" (2003)

23Dave Ramsey, Financial Peace (1992)

24Suze Orman, The Money Book for the Young, Fabulous & Broke (2005)